Counterparty Credit Risk (Bundle)

₹10,000.00

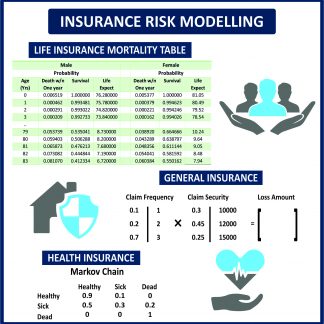

Accurate pricing of derivatives products requires adjustment of Counterparty Credit Risk. This module covers the various terminologies and components behind CCR modelling using real life datasets in excel.

The zip contains the following excel sheets-

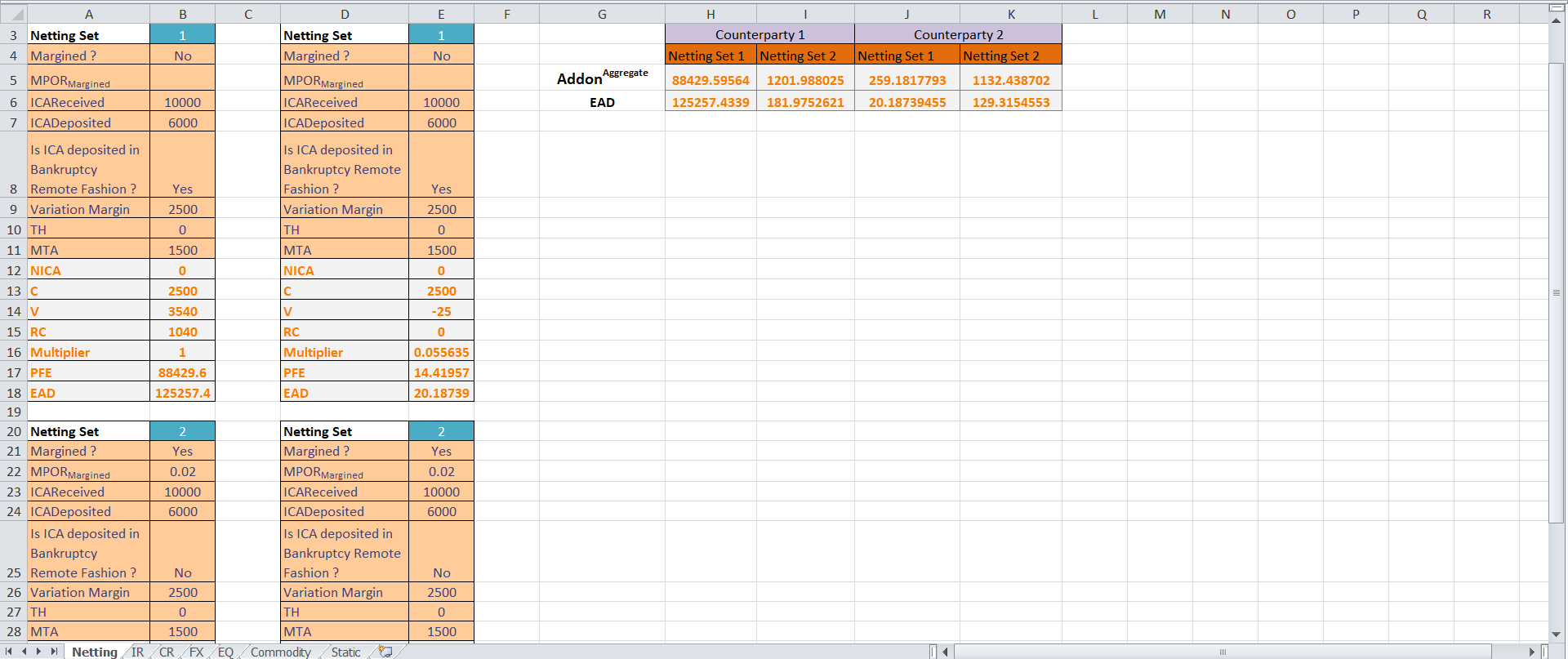

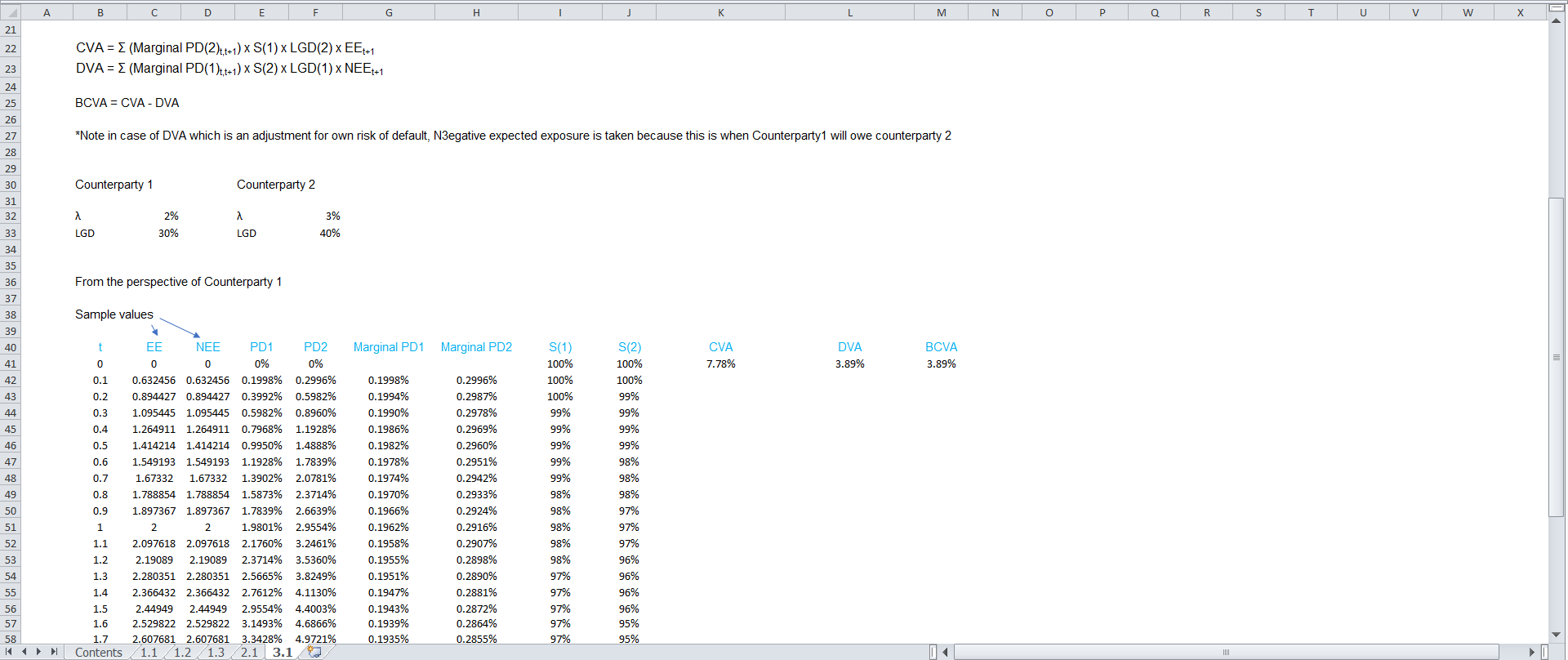

1. Calculation of CVA, DVA & FVA

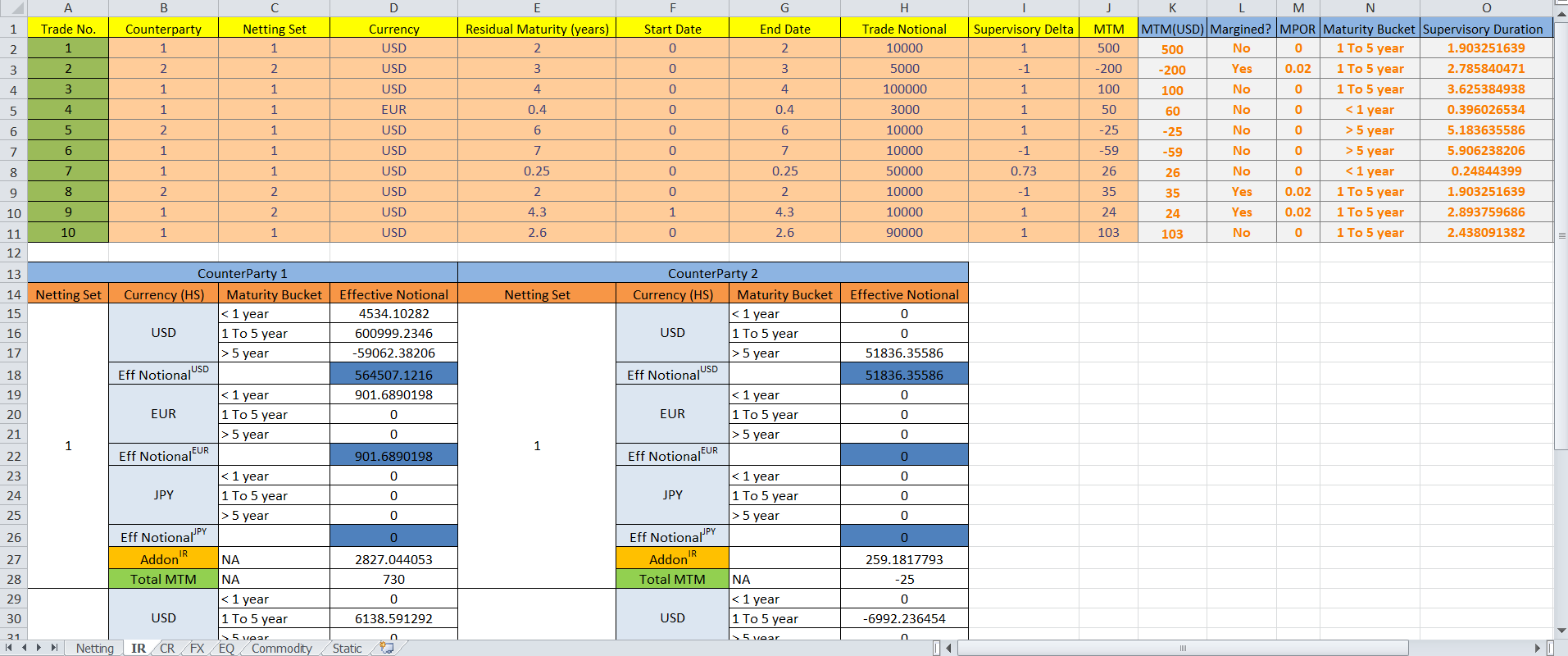

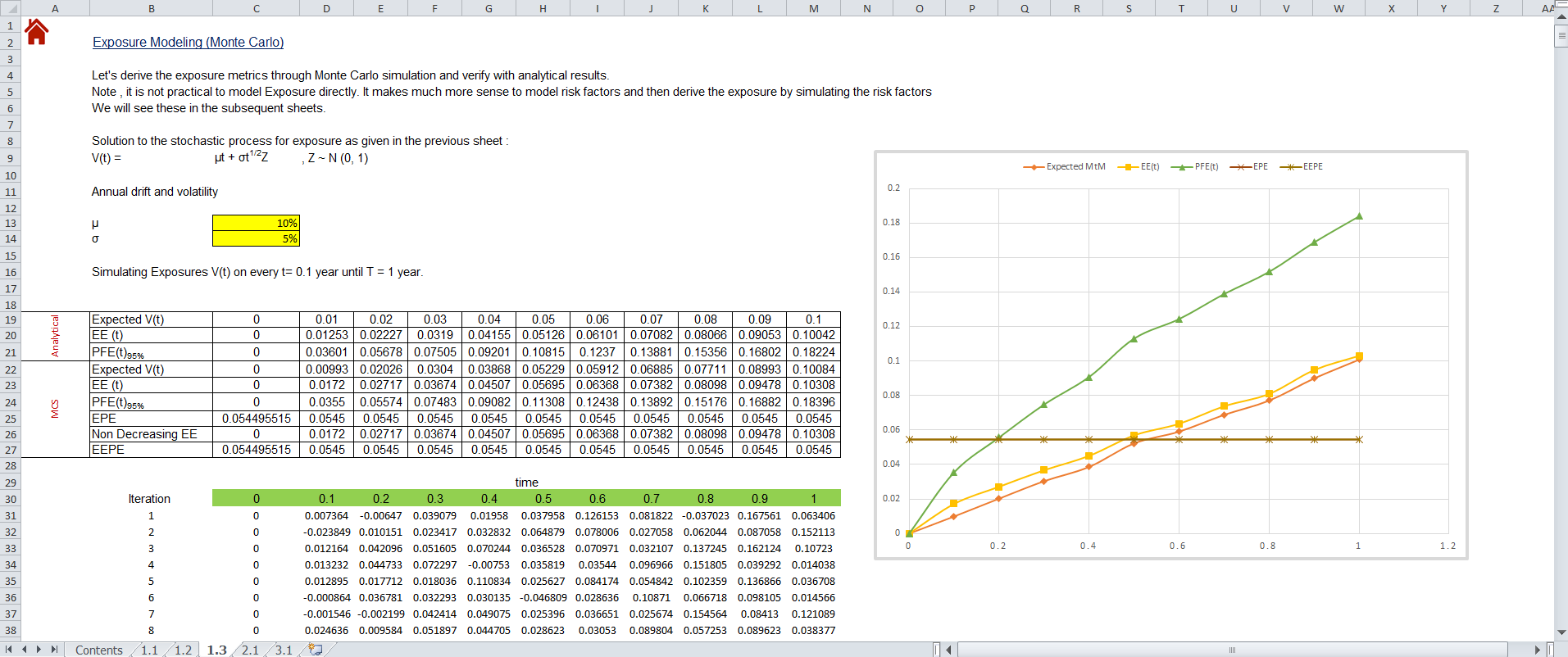

2. Exposure Modelling – Expected MTM, EE, PFE, EPE, EEPE

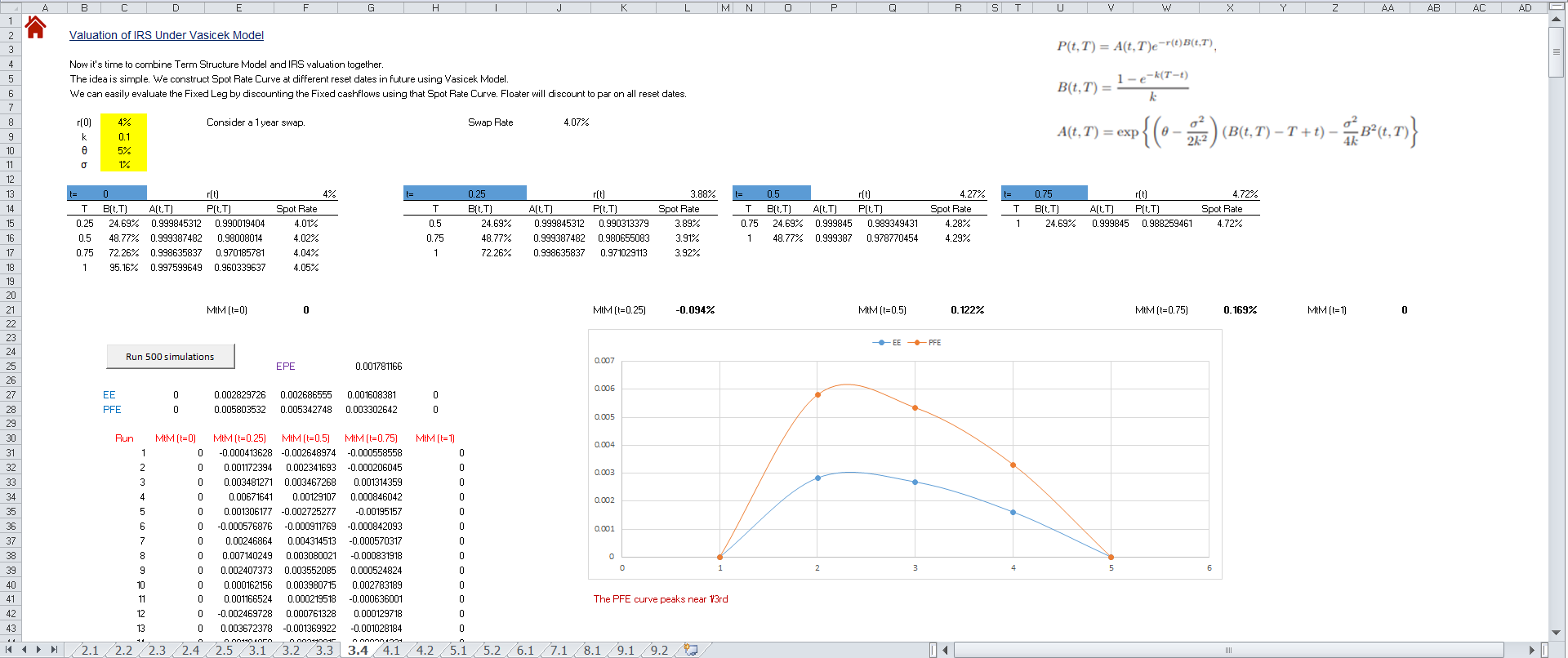

3. EE & PFE of Interest Rate Swap using Vasicek model

4. EE & PFE of Forward Rate Agreement

5. EE & PFE of FX forward

6. EE & PFE of Option

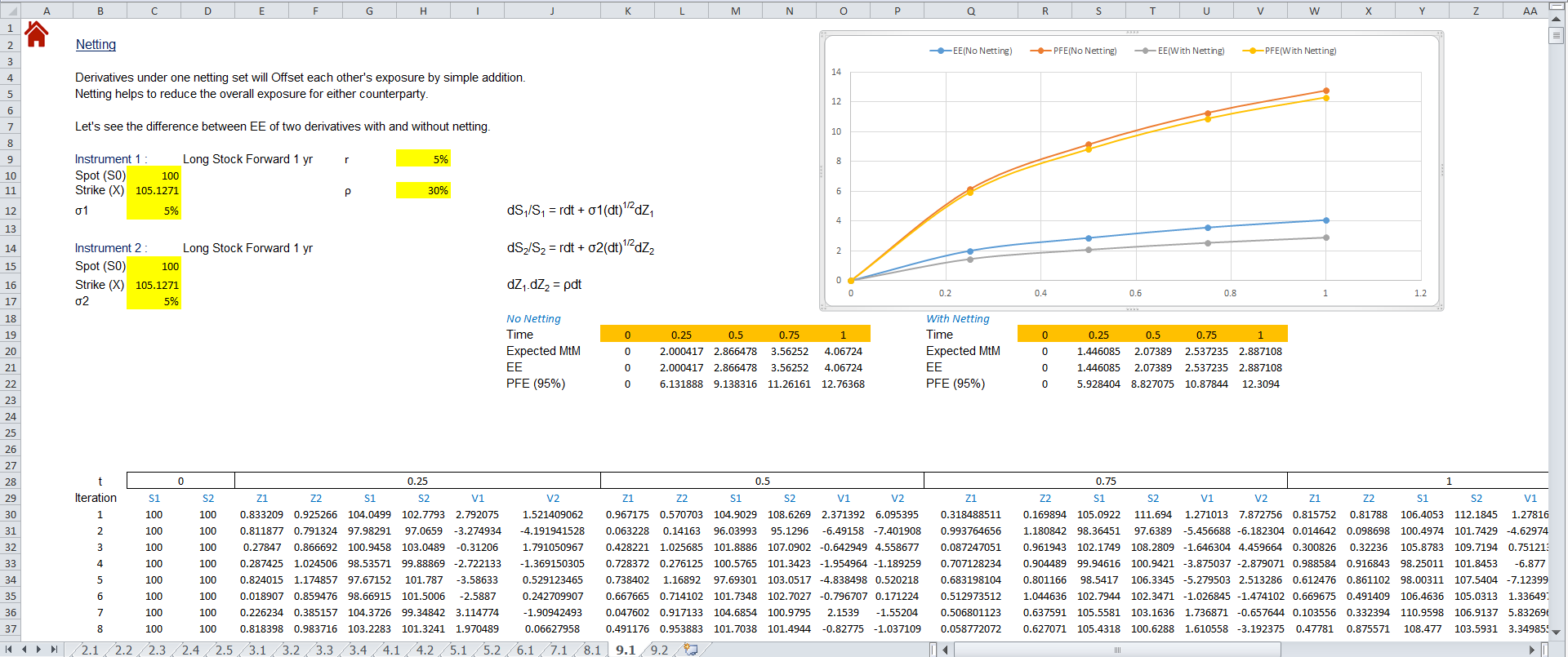

7. Impact of Netting & Collatera

8. Modelling Wrong Way Risk

9. Calculating CVA Capital Charge

Reviews

There are no reviews yet.