Risk Management

Risk Management in banking and insurance industry make use of heavy statistical models. Regulatory capital requirement framework such as Basel, FRTB are deeply rooted in statistical ideas which requires thorough understanding of Quantitative model development. One has to navigate the labyrinth of complex mathematical literature on a plethora of topics to fully grasp the idea behind these frameworks. Internal Risk management today makes use of cutting edge analytics which can be daunting for a beginner. XL-Mate makes this journey extremely easy for a new comer by taking a methodical approach and introducing the topics in a stepwise fashion with every bit calculation performed on spreadsheets. With XL-Mate you can see every single risk theory and principle in action with rich visualization and complete transparency of calculation

Showing all 8 results

-

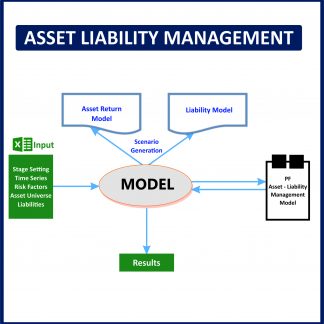

Asset Liability Management using Excel (Coming Soon)

Read more -

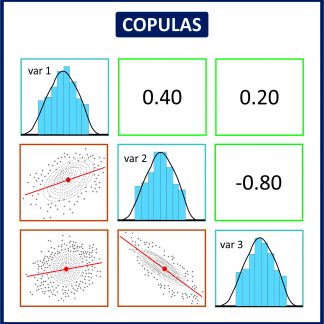

Copulas using Excel

₹1,200.00 Add to cart -

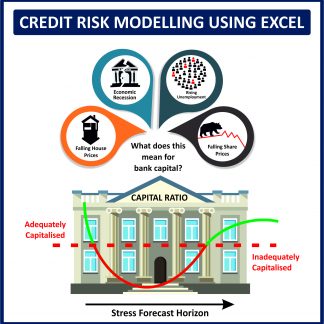

Credit Risk Modelling using Excel

Read more -

Basel Model Development using Excel (Bundle)

₹10,000.00 Add to cart -

Counterparty Credit Risk (Bundle)

₹10,000.00 Add to cart -

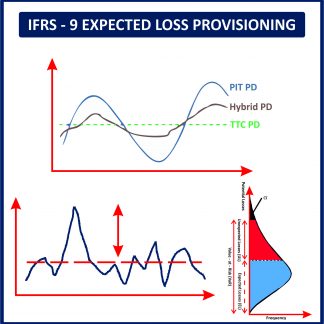

IFRS – 9 Expected Loss Provisioning using Excel

₹5,000.00 Add to cart -

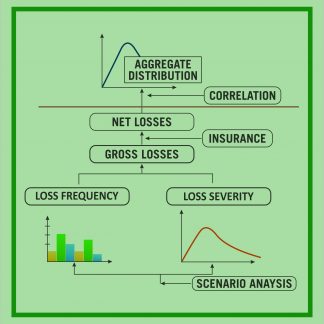

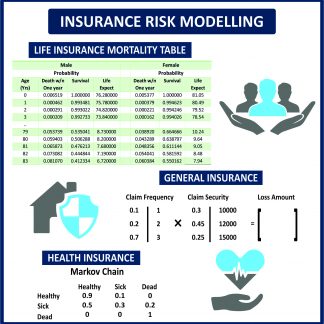

Insurance Risk Modelling using Excel (Coming Soon)

Read more -

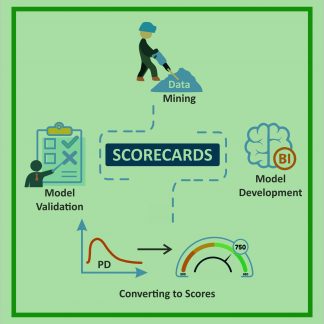

Scorecards using Excel (Bundle)

₹5,000.00 Add to cart

Showing all 8 results