Derivatives Valuations using Excel

₹10,000.00

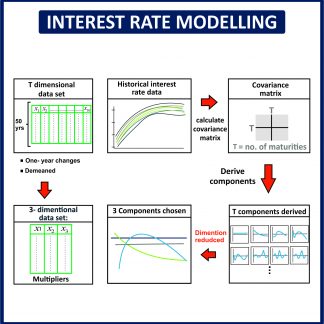

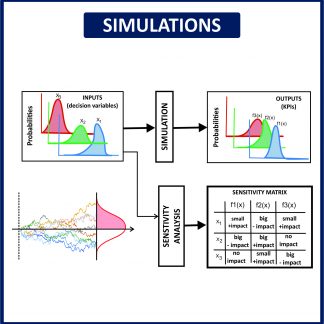

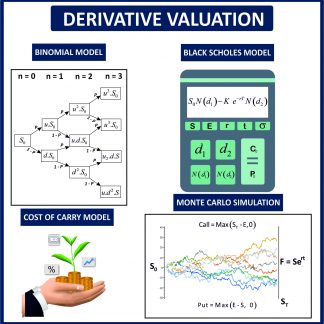

Derivatives are financial products whose value depends on another variables. Derivatives can be used to hedge, speculate, increase or decrease leverage, locking in profits or losses and changing nature. The key ingredient for valuation of derivatives is no-arbitrage condition. This zip contains valuations of the following derivative products

1.Options Valuation using Binomial & Black Scholes model

2.Valuation of Exotic Options

3.Valuations of Interest Rate Swaps

4.Valuations of Forward Rate agreements

5.Valuations of FX Forward

6.Valuations of Credit Default Swap

7.Valuations of CDOs

8.Valuations of Mortgage Backed Securities

Reviews

There are no reviews yet.