Basel Model Development using Excel (Bundle)

₹10,000.00

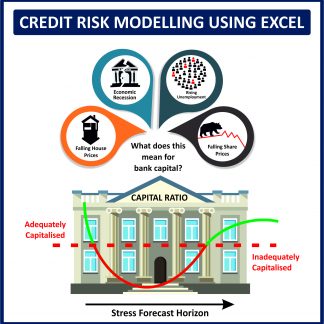

Banks need to comply with Basel standards and calculate Regulatory capital under Internal Rating Based approach by modelling PD,LGD,EAD internally. This excel module decodes the complexities in Basel Modelling step by step.

The zip contains 13 Excel sheets showing the following steps of Basel Development stepwise-

1. Preliminary data inspection & cleanup

2. Building a Modeling Data Dictionary

3. Data Reconciliation – Source to Target Mapping

4. Data Quality Check – missing observation analysis and outlier analysis

5. Model Design – Creating Snapshots, Observation & Performance period, Seasoning analysis.

6. Model Development- Logistic Regression, Decision Trees, Kaplan-Meier, Cox proportional Hazard models, Accelerated Failure Time (AFT) Models

7. Model Validation – In Sample validation, out of sample validation & out of time validation

8. Segmentation analysis – Decision trees

The excel sheets comes accompanying with a PPT explaining all the steps.

Reviews

There are no reviews yet.